Impairment

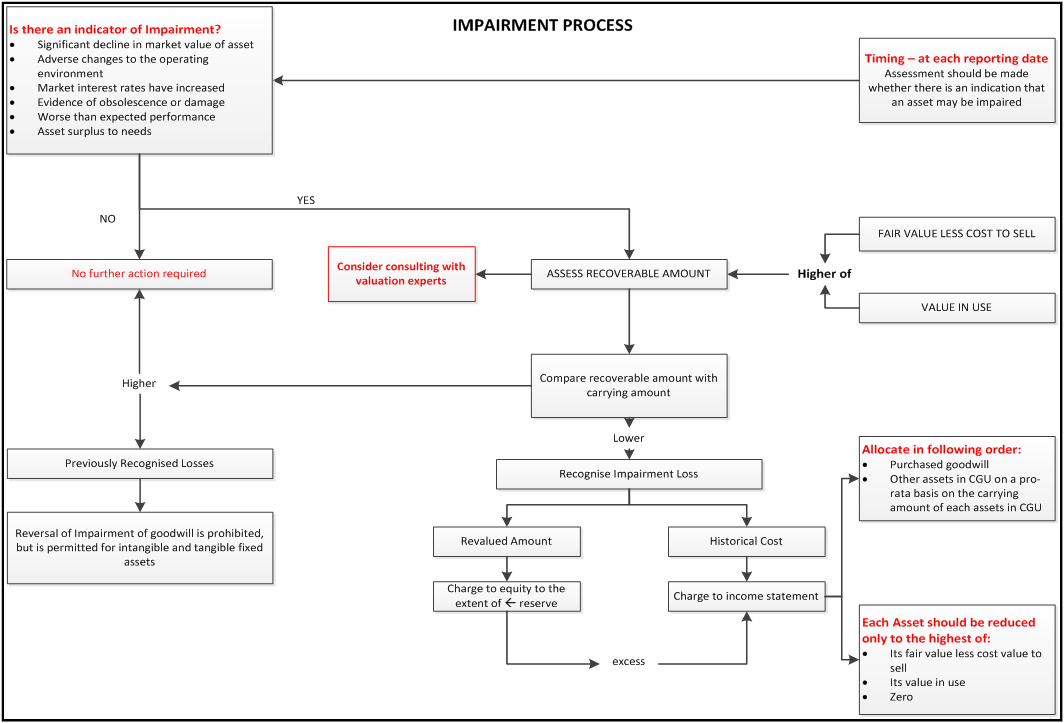

Basic Principles of Impairment

- An asset should not be carried in the balance sheet at a value greater than its recoverable amount.

- Recoverable amount is measured as the higher of an asset’s fair value less costs to sell and its value in use.

- If the recoverable amount of an asset is less than its carrying amount, the Council should reduce the carrying amount to the recoverable amount. The reduction is recognised as an impairment loss.

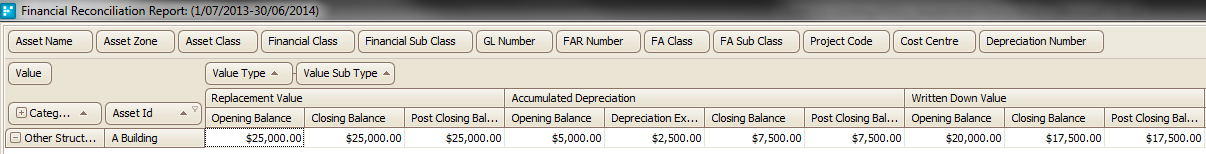

Scenario:-Take a building asset that is recorded in the balance sheet worth $20,000 (book value or carrying value is $20,000 - Refer the report below).

Based on the asset's book value, assume the building has a historical cost of $25,000 and accumulated depreciation of $5,000.

A flood sweeps through the town and damages the building.

After assessing the amount of the damage, the assessor calculates that the building's value has fallen to $10,000 (based on it's current condition).

Impairment Date:- 01/07/2013

The Loss on Impairment is calculated to be $10,000 ($20,000 book value - $10,000 market value)

The journal entry to recognise the Loss on Impairment:

- Debit Loss on Impairment for $10,000

- Debit Building-Accumulated Depreciation for $5,000

- Credit Building for $15,000

The Loss on Impairment for $10,000 is recognised on the income statement as a reduction to the period's income and the asset Building is recognised at its reduced value of $10,000 on the balance sheet ($25,000 historical cost - $10,000 impairment loss - $5,000 accumulated depreciation).

After the impairment, depreciation expense is calculated using the asset's new value.

Steps below outlines how to impair asset in myData

1.Select asset

A record can be selected either by initiating Search or by navigating to the asset from the navigation panel directly.

2.Impair

To impair an asset in myData there is an inbuilt tool - Impair. Click icon on the menu bar to initialise Impairment process.

icon on the menu bar to initialise Impairment process.

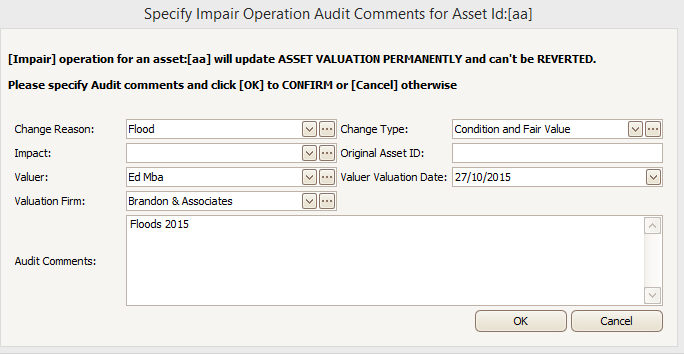

Following Screen will appear;

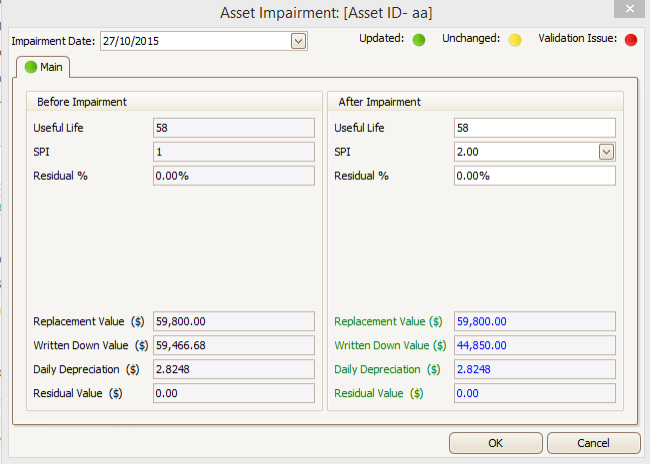

3.Update Financials

The condition of the asset has deteriorated after the floods.

The new condition as assessed by assessor is 2 (on a scale of 0-5).

Change the condition as per the screen above.

In the above form populate data in the following fields and click OK.

- Impairment Date:- Date on which the asset is Impaired. This date should be within the current FY

- Useful Life: - The new life as assessed by assessor.

- Residual %:- The new value as assessed by assessor.

Populate the Audit Train details in the next screen.

- Audit Trail: - Populate as per your business process manual.

4.Financial Reports

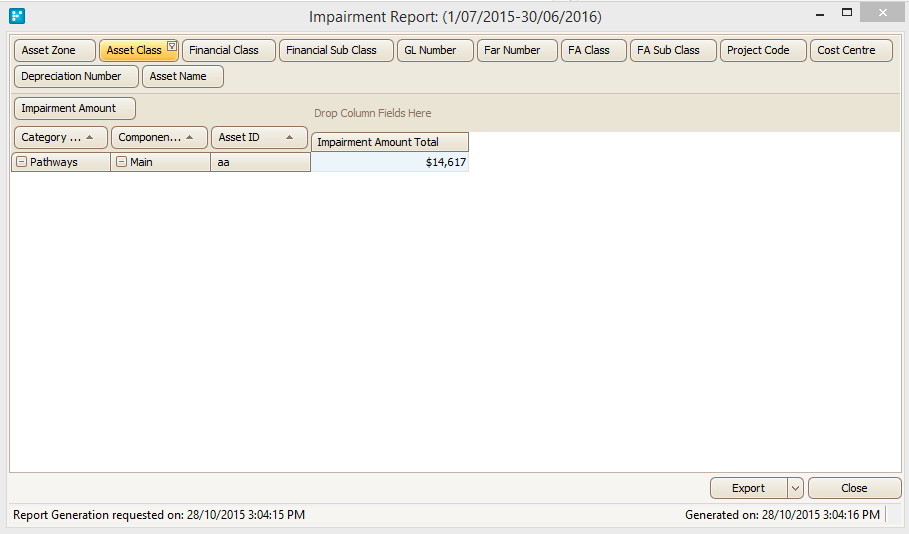

A. Impairment Report

There is an in-built report in myData - Impairment. Run this report. See below.

This report shows the loss on Impairment.

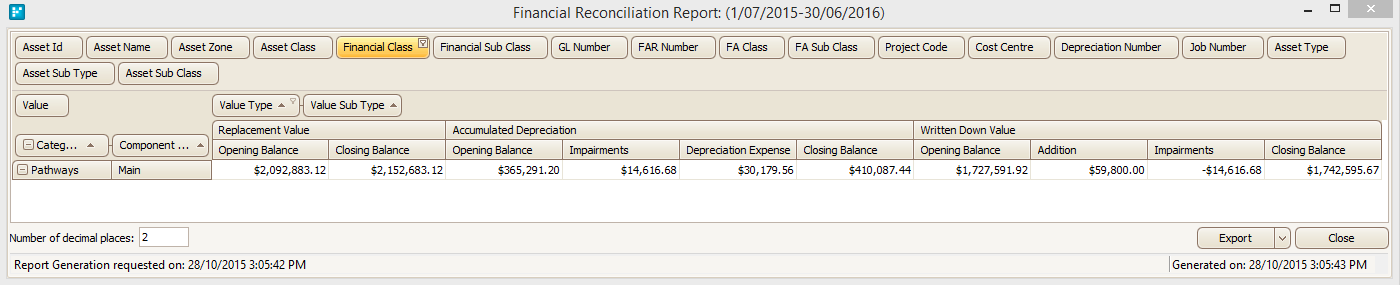

B. Financial Reconciliation Report