Depreciation Schedule

Many sectors, like Water Authorities, are legally bound to submit the depreciation schedules of their asset stock to the Australian Taxation Office (ATO).

The calculation method is completed for taxation purposes rather than for Fair Value.

The ATO allows two very different methods of calculating property tax depreciation deductions; the Diminishing Value Method and the Prime Cost Method.

Both methods of depreciation claim the same total value over its expected life.

They utilize different rules however, to achieve either aggressive upfront claims or a more consistent claim each year.

The key differences between the Diminishing Value and Prime Cost Methods:

|

Diminishing Value Depreciation Method |

Prime Cost Depreciation Method |

|

|

Prime Cost Depreciation Method:

The Prime Cost Deprecation Method is a way to account for the impact of depreciation on the value of assets.

The prime cost method (also called the straight-line method) assumes that the value of an asset decreases at a uniform rate over time.

Under the Prime Cost Method, the deduction for the decline in value is based on the cost of the asset.

The calculation for depreciation is:

Asset's Cost X Days Held X 100%

365* Effective Life

*Can be 366 in a leap year.

Generally the estimate of the useful life is completed by the agency, but in absence of the data, it can be obtained from the ATO.

Diminishing Value Method:

- Produces a progressively smaller decline over time, and

- Gives a higher deduction for decline in value in earlier years than the prime cost method

The formula is:

Base Value X Days Held X 200%

365* Effective Life

*Can be 366 in a leap year.

The base value is:

- The cost of the asset in the income year in which the asset's start time occurs, or

- In a later year, the sum of its opening adjustable value for that year and any amount included in the second element of its cost for that year (such as the cost of an improvement).

Days held is the number of days the asset was held in the income year from its start time, (ignoring any days in that year when it was not):

- Used, or

- Installed ready for use for any purpose.

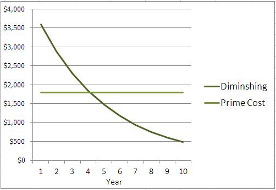

A line graph clearly shows the result of the diminishing method and its decreasing deductions versus the constant deductions of the prime cost method.

Note: This tab is only activated for the agencies that are required to submit their returns to the ATO.

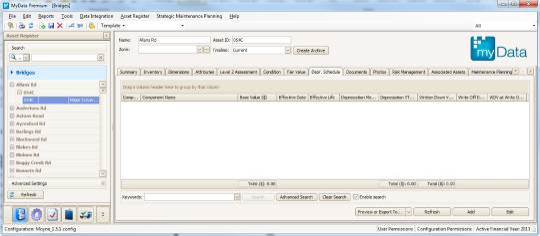

All the formulas listed above are built into the Depreciation Tab. To calculate Depreciation and other financial information, select Add at the bottom of the screen on the Depreciation Schedule.

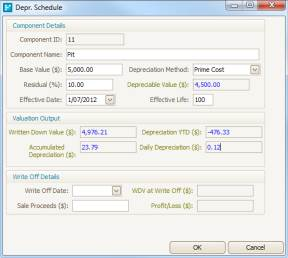

Input Fields

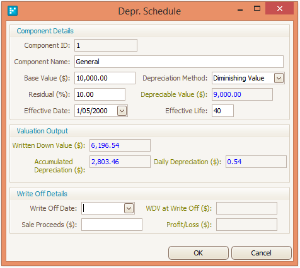

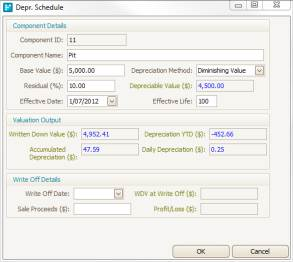

Component Name: - Users can choose to calculate depreciation for the entire asset or to apply it on individual components. The data entered will appear on the report.

Base Value: - Is the total value of the asset

Depreciation Method: - Select from drop down box

Residual (%):- Is the salvage value

Effective Date: - is the date when the asset is:

- First used or

- When it is installed ready for use for any purpose

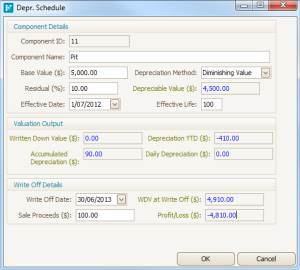

In the example below for a Pit asset, the difference between the calculated values based on the method applied, are shown:

Diminishing Value Calculations

Prime Cost Method Calculations

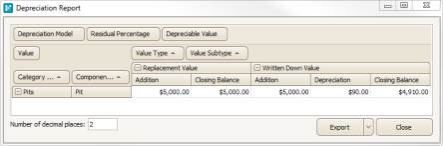

On clicking OK, the entry will be created against an asset. The details can be viewed in the Depreciation report.

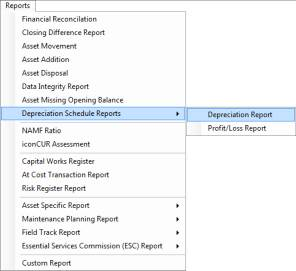

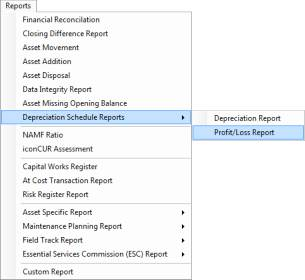

To generate the report, select the Depreciation Report from the Reports menu as shown below:

If the asset is Written Off, the values are then populated in the Write Off Details section:

To generate the report, select the Depreciation Report from the Reports menu as shown below:

Data for multiple assets can be imported using the Data Integration option.