Indexation

In this scenario we will apply indices to the unit rate of an asset or to unit rates of all the components of an asset, to arrive at the current required asset value.

Indices derived from government entities (e.g. Bureau of Statistics or CPI in Australia) may be used for indexation purposes.

Indexation should only be done once all transactions are completed (disposals, splits, data corrections, etc.) in myData.

Generally, Indexation (desktop revaluation) is carried out at the end of Financial Year.

There is an inbuilt tool in myData that will facilitate the indexation process. Please follow the steps below;

1: Close 1

Under the Asset Register menu click Close Financial Year (Start Revaluation) option.

This begins the Close Financial Year process (Close 1).

Users are recommended to generate all the necessary reports from myData before Close 1 commences.

Please follow steps as in End of Year Revaluation scenario to perform Close 1 in myData.

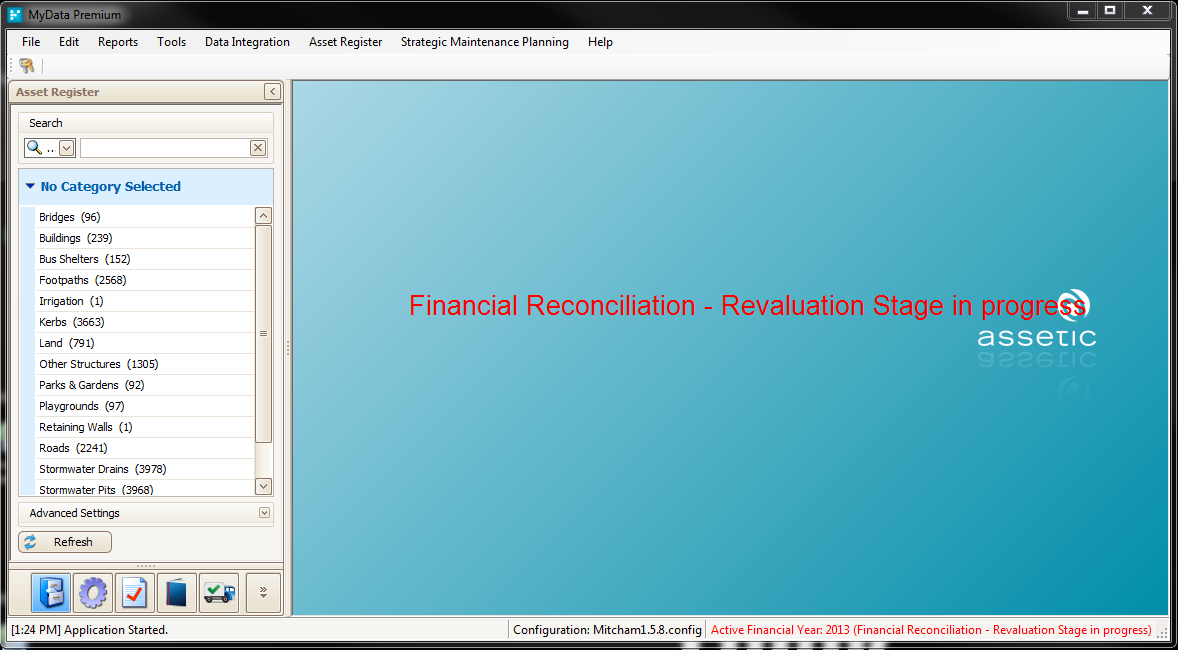

Once myData restarts user will see the following screen:

2: Close 2

Under the Asset Register menu click Close Financial Year (Finalise Revaluation) option (Close 2).

Wait until myData finishes some default procedures and data calculations.

3: Apply Index

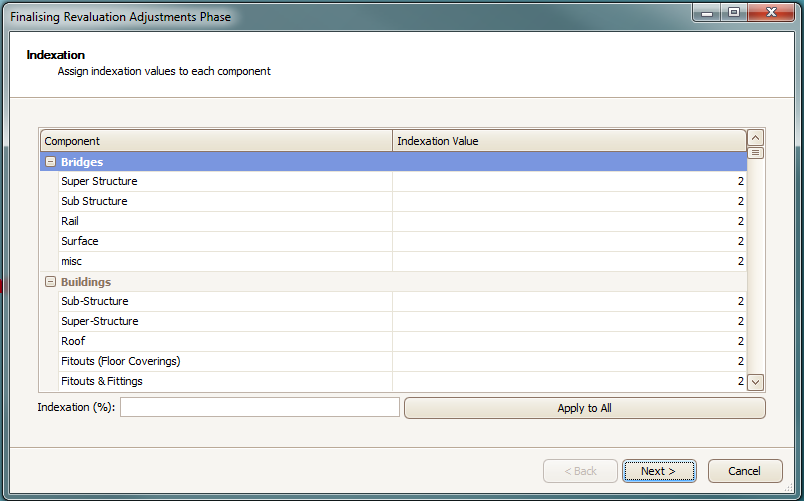

Populate each asset and its component with an index number as shown in the screen below:

If you want to apply the same %age populate the index number in  this box and click

this box and click

Once done and verified click next to finish the process.

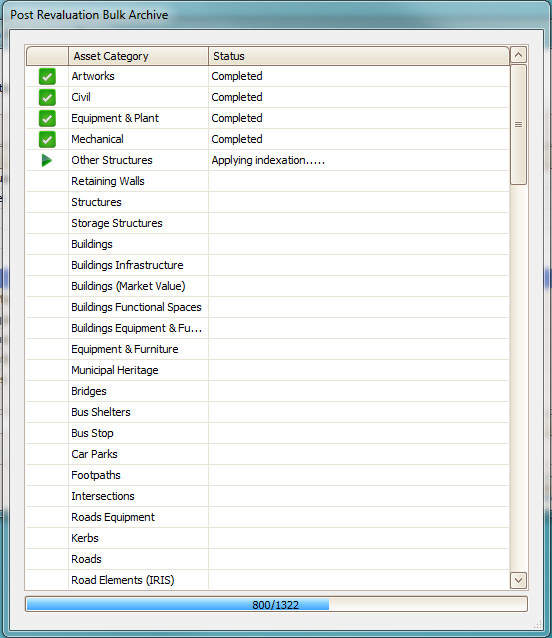

Wait until myData finishes archiving.

Finish the screen by clicking.

4: Reporting

Once myData restarts run the following financial reports

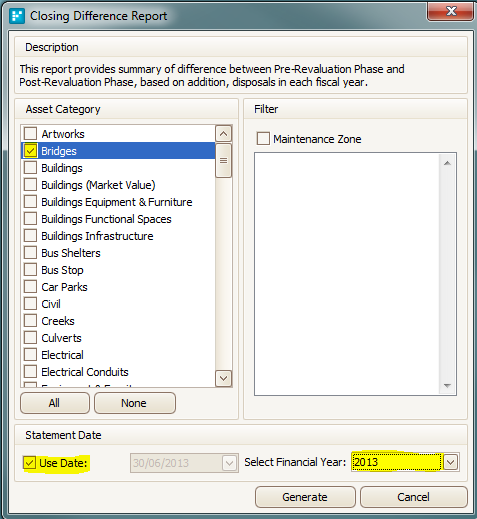

- Closing Difference Report

NOTE: Please tick the 'Use Date' box as shown below and select previous financial year as you have rolled over myData to the new financial year.

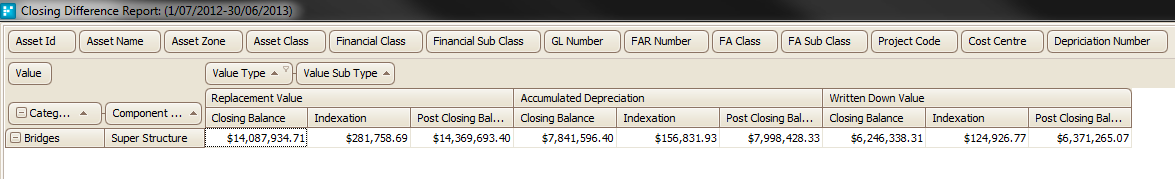

The following report will be generated

The above report clearly shows that myData closed with a balance of $14,087,934.71 (replacement value) and after indexation the post closing balance is $14,369,693.40. Value increase due is indexation is $281,758 which is 2% of the original value.

Same %age gain is applied to accumulated depreciation and written down value.

NOTE: The Post Closing balance now becomes the opening balance for the next financial year.