Work in Progress

In this example we will consider a situation where Council has spent monies in the current financial year, however as the works have yet to be completed, the funds to complete the project are carried into the following financial year.

This stage of a project is referred to as Works in Progress (WIP).

Some examples of WIP is where monies have been expended under the planning stages of the project or as a result of land acquisition or in most cases, due to the projected scheduled time frame the project is not able to be completed by the 30 June and hence will need to remain open so that it can be completed in the following financial year.

For WIP transactions to show up in the myData Financial Reconciliation Report the following steps below should be followed:

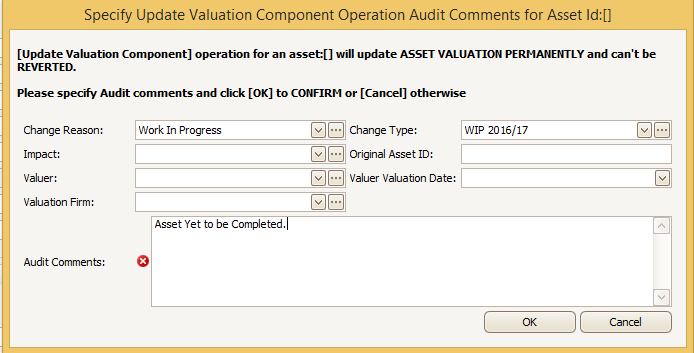

1. Create WIP Record

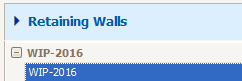

Create a single record with Asset ID and Asset Name = 'WIP' in the required asset categories.

This is for attending to those values where the asset does not exist at all.

If an asset already exists, add the WIP amount in the relevant component of that asset, as highlighted below:

2. Adding WIP

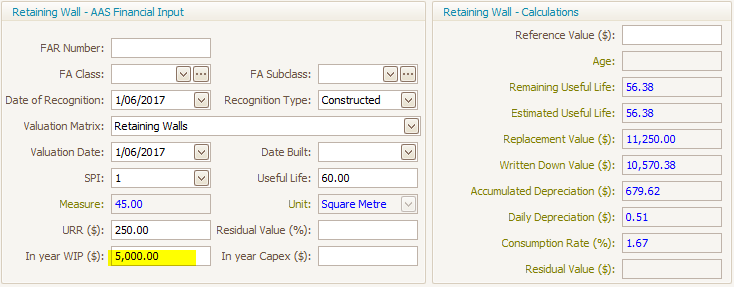

Where the asset does not exist at all, add the total WIP value for the entire project in the 'In Year WIP ($)' field located in any of the asset component financials.

3. Financial Dates

Add Date of Recognition and Valuation Date as the end of current financial year date (e.g. 30/06/2017 for the year 2017).

Add recognition type as 'Constructed or Purchased'.

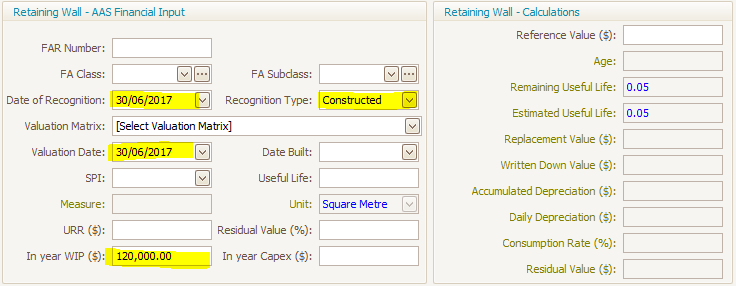

Populate the audit trail comments with 'Asset yet to be completed'.

4. Financial Report

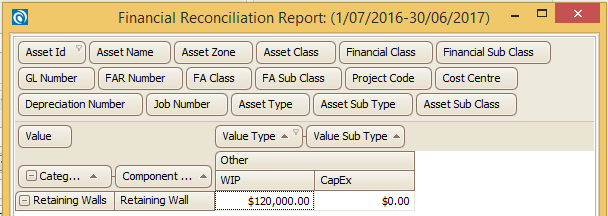

Generate the Financial Reconciliation Report.

WIP figures allocated are shown in the WIP column of the report.

Note: Repeat this process for all other asset categories having similar scenarios.

5. Closing

Close the Financial Year in myData.

6. Dispose asset

In the new Financial Year (2017/2018), when assets are ready for acquisition, add the actual asset as new assets.

Deduct the asset value from the existing WIP and alter the WIP figures if required.

Once all the WIP is assigned to the actual assets, delete the 'WIP' record.