Partial Disposal & Capitalisation

To partially dispose of an existing asset and capitalise it, we will use an example from the Drainage Pipe Asset category.

A new Pit is constructed on an existing drainage line in a new location.

As a result of this works a 102m pipe is now corrected to 100m.

The remaining 2m portion of the drainage line (after the new Pit) is decommissioned as it no longer exists.

The 100m section is now replaced with new pipe.

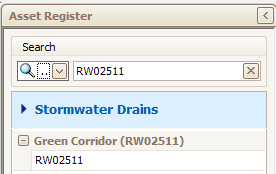

1. Select Asset

Click on the Search field and type the name of the asset if known or any other identifier such as Asset ID, which will assist you in locating the existing asset in the Register.

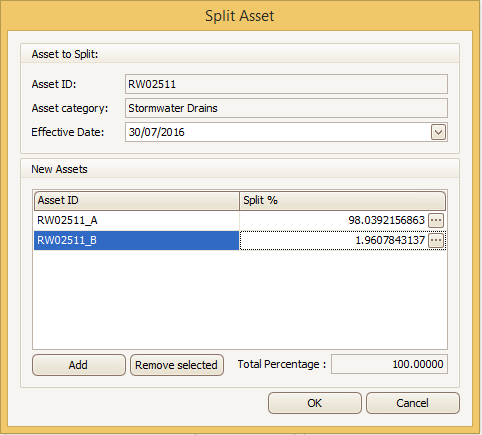

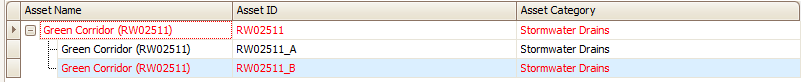

2. Split Asset

Split the asset into two parts.

Refer myData manual for 'Asset Split'.

3. Dispose Asset

Select the 2m pipe segment ('RW02511_B') which is now considered to be decommissioned and dispose of it.

Refer 'Disposal' scenario on how to dispose an asset.

In the example above, which can be viewed in the summary tab, the section of the pipe 'RW02511_B' was decommissioned and is disposed using the 'Disposal' tool in myData.

4. Capitalise

100m section of the pipe is replaced with a new pipe.

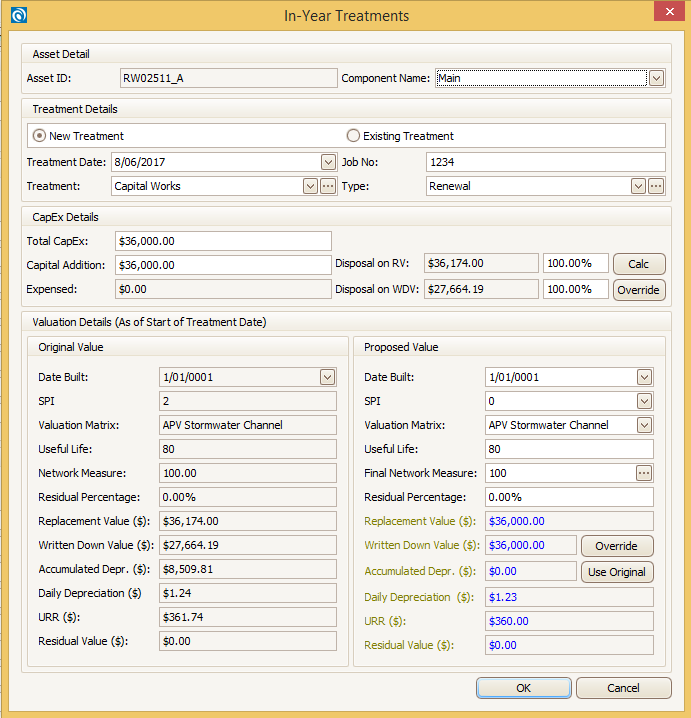

To capitalise asset 'RW02511_A' follow the capitalisation process as described in 'Capitalisation' scenarios, using the In-Year Treatments Icon.

User Input

In the above form populate data in the following fields:

- Treatment Date:- Date on which the asset was treated. This date should be within the current FY and later than the existing valuation date.

- Treatment: - Can be selected from the drop down menu. The drop down items is same as in Treatment tab.

- Type: - Type of treatment can be selected from the drop down menu. The drop down items is same as in Treatment tab.

- Job No: - Job No, work Order No or any reference number allocated to this project.

- Total CapEx: - This is the total amount spend.

- Capital Addition:- This is the net amount spend for the works (Items like site clearance, rubbish removal etc. can be deducted from total spend to get the net spend).

- Proposed SPI:- For the renewal the proposed SPI can be modified depending on the percentage of renewal. (If only certain portion of the entire asset is replaced which hasn't changed the overall SPI of the asset than the proposed SPI can be same as current SPI, but if a bigger chunk is either replaced or renewed than the overall condition may improve). When full asset renewal has occurred the SPI will be set to the highest score, being 0.

- Useful Life: - Depends on the type of treatment and quantity of asset treated. (E.g. If a majority part of an asphalt footpath has been replaced by concrete footpath, the useful life of the asset can improve).

- Final Network Measure:- Total area of asset after the works. This area can be less or more than the original area. To change the area click on these

dots and following will appear.

dots and following will appear.

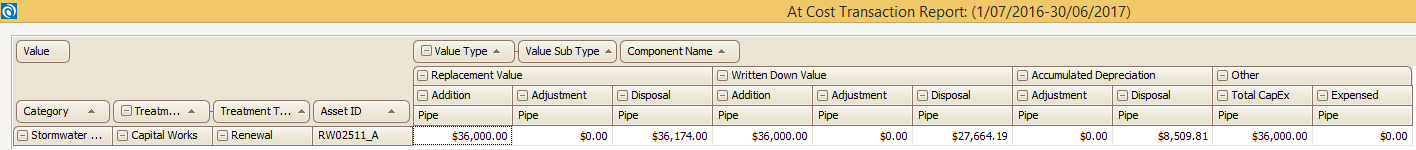

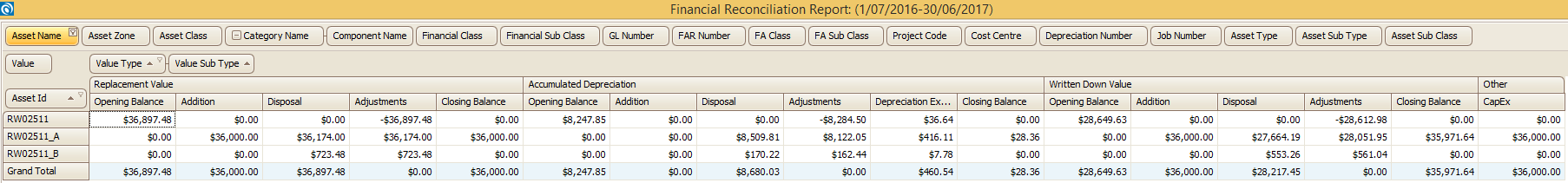

5. Reporting

Asset Split will not have financial implications.

However the portion of the asset that has been disposed after split will be reported as Disposal in the Financial Reconciliation Report.

In the report above 'RW02511' is reported as adjustment as this asset was split and now has a '0' closing balance.

Asset 'RW02511_A' is current asset and it has the new value as closing balance and asset 'RW02511_B' is disposed as it was decommissioned and is reported as Disposal.

As we have treated 'RW02511_A' asset $36,000 is shown as addition and the same values is reported as CapEx value.

For detailed information about the movements on asset 'RW02511_A' , refer At-Cost Transaction report. $36,174.00 is reported as disposal and $36,000 is reported as addition. Written Down Value addition and disposals are reported in the report below.