Capitalisation of Work in Progress

Capitalising the capital expenditure cost of an asset, which was considered to have been Works In Progress (WIP) in either the previous year or current year.

1. Identify WIP Assets

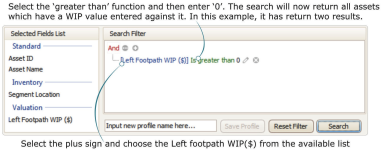

Click  the Magnifying Glass icon and then the Advanced Search function to return the report query builder.

the Magnifying Glass icon and then the Advanced Search function to return the report query builder.

Note: From the Advanced Search you can only search for WIP on a single asset category at a time.

Using the Financial Reconciliation report you are able to search for WIP on multiple asset categories.

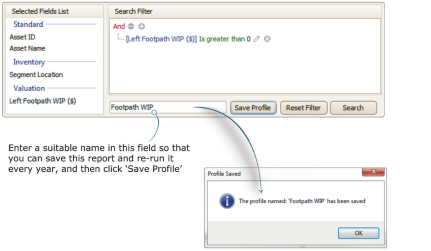

2. Save Search Profile

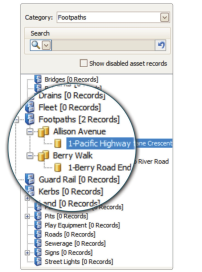

3. Select Assets

Once the advanced search has been run, the navigation tree is reduced so you can now easily identify the asset records, which have a WIP amount, recorded against them.

4. Capitalise or Expense Values

You may capitalise or expense these financial values as per Scenarios 4 or 5.

Important Note: You must re-set all the WIP values back to zero once you have attended to these values.