Capital Disposal

This scenario will cover process for Capital Disposal.

Example: There is an existing Bus Shelter which is due for renewal.

The old shelter is removed and is replaced with brand new bus shelter.

Council has not spent any money for the renewal of this shelter as the project was funded by State Government.

The new shelter is now no longer owned by Council but the Council still has the maintenance responsibility.

So the current value of the bus shelter has to be disposed.

The asset still stays active in the asset register but without any financials.

To deal with such scenarios, please follow the steps outlined below.

1. Select Asset

A record can be selected either by initiating Search or by navigating to the asset from the navigation panel directly.

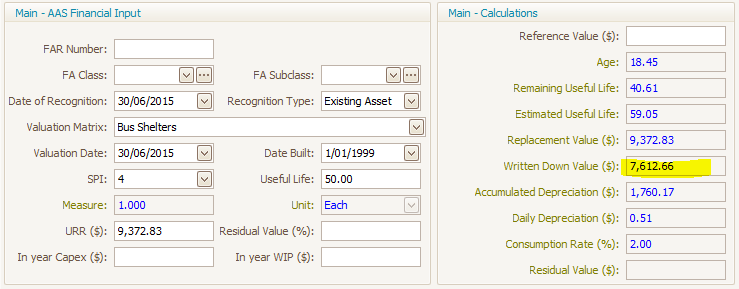

The current written down value of the Shelter is $7,612.66 as below.

2. In-Year Treatment

To dispose the value of an asset as mentioned in the scenario above, click on the  ‘In-Year Treatments’ icon.

‘In-Year Treatments’ icon.

Make sure that the asset to which this updates are required is selected prior to selecting the ‘In-Year Treatments’.

In this example, we have selected an Bus Shelter Asset.

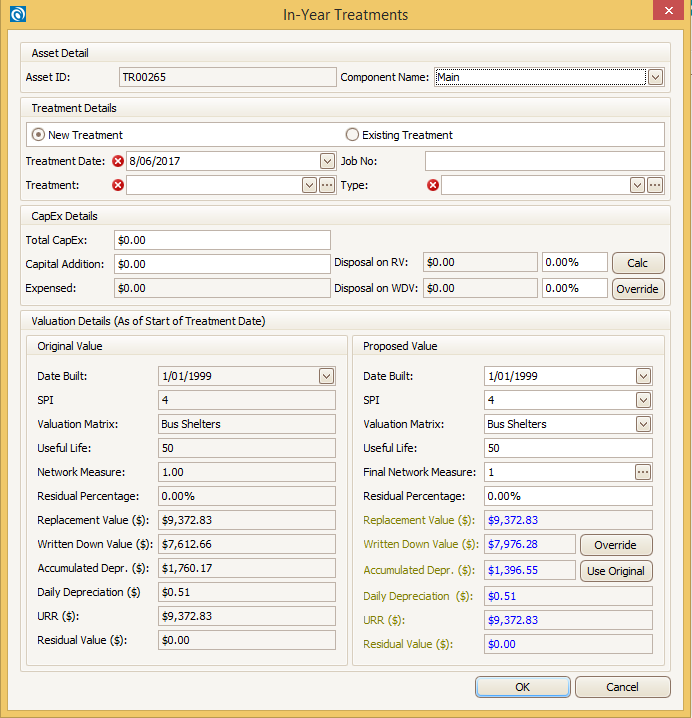

On clicking the icon following screen will appear.

3. Update Data

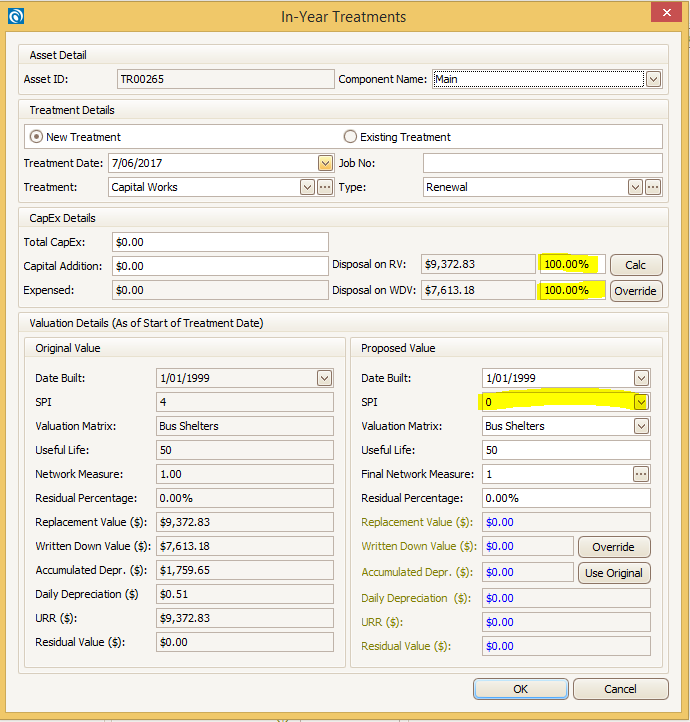

Update the data in the 'In-Year Treatment' screen as below:

- Treatment Date: Date on which the asset was treated. This date should be within the current FY.

- Treatment: Can be selected from the drop down menu. The drop down items is same as in Treatment tab.

- Type: Type of treatment can be selected from the drop down menu. The drop down items is same as in Treatment tab.

- Total CapEx: This is the total amount spent. In this scenario there is no amount spent by Council as the project was funded by State Government.

- Capital Addition: This is the net amount spent for the works (Items like site clearance, rubbish removal etc. can be deducted from total spend to get the net spend). In this scenario there is no amount spend by Council as the project was funded by State Government.

- Proposed SPI: As the asset has been replaced with a brand new asset the SPI should be rest to 0 - Brand New (as per your business process manual).

- Useful Life: Depends on the type of treatment and quantity of asset treated.

- Disposal on RV: In this scenario we are disposing the Replacement Value (RV) of the asset totally and therefore the disposed RV will be 100% of the value.

- Disposal on WDV: In this scenario we are disposing the Written Down Replacement Value (WDV) of the asset totally and therefore the disposed WDV will be 100% of the value.

- Final Network Measure: Total area/quantity of asset after the works. This will remain the same.

Refer the screen below for further details.

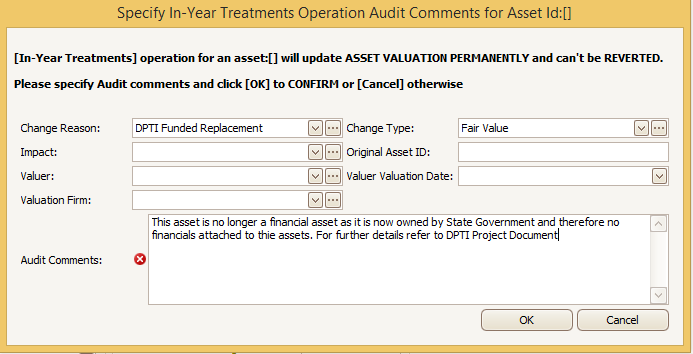

Click 'OK' to finalise the treatment. Following screen will appear.

4. Audit Trail

Update audit trail section with appropriate comments and save the asset.

Whilst you have the asset selected, click on the blue disk icon  from the toolbar to save this asset record.

from the toolbar to save this asset record.

5. Reporting

Note: By treating the Transaction in this manner, the Financial Reconciliation Report generated in myData will identify this asset as a Capital Disposal for the year.

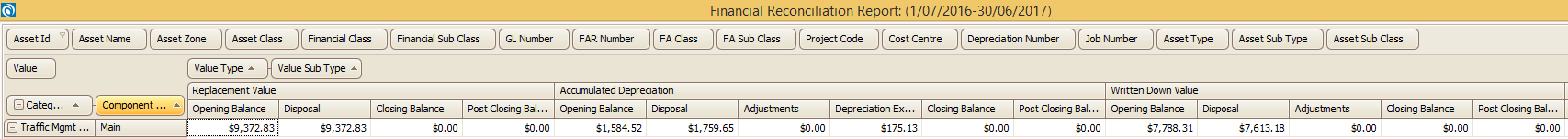

Refer the report below.